Resources

Greenhouse Gas Protocols

The process of measuring an organization’s carbon emissions is defined by the framework for carbon accounting – The Greehouse Gas Protocol (GHGP). This ensures that your calculations and reporting is in line with a standardized framework. Accuracy is depended on first defining the organizational and operational boundaries of carbon measurements.

Organisational Boundaries

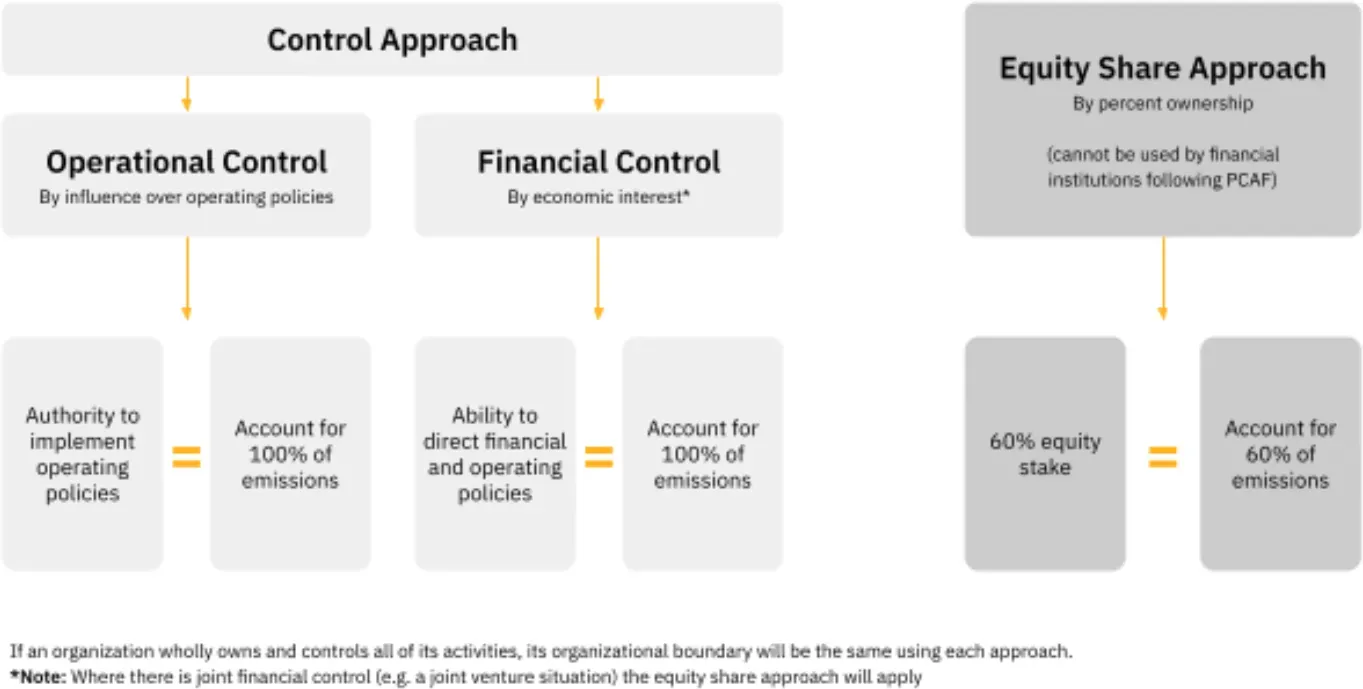

An organizational boundary is an essential framework, dictating the extent of control an organization has over the emissions produced within its operations. The primary methods for defining organizational boundaries are the equity share approach and the control approach.

Equity Share Approach

The equity share approach is a technique employed to ascertain an organization's responsibility for greenhouse gas (GHG) emissions, contingent upon its ownership interest or equity share in other entities. The emissions attributed to an organization are calculated in accordance with its ownership proportion or controlling interest in affiliated companies or subsidiaries.

Control Approach

Under the control approach, a company is responsible for 100% of the emissions over which it has either financial control or operational control.

Financial Control

A company falls within the financial control boundary if it bears the majority of risks and benefits associated with owning the assets of the operation and exercises overarching control over financial policies. This designation does not inherently imply that the company holds a majority ownership stake in an organization.

Operational Control

The operational control boundary is applied when an organization or one of its subsidiaries exercises complete authority over the day-to-day operational policies of a company.

Operational Boundaries

These boundaries distinguish between emissions directly generated by the organization (direct emissions) and those stemming indirectly from activities within the organization but taking place at sources outside its jurisdiction (indirect emissions). Operational boundaries aid companies in identifying, measuring, and addressing their carbon footprint across different emission sources within their business operations and value chains.

Direct and indirect emissions are broken down into Scope 1, 2, and 3, per the GHGP:

- Scope 1 refers to the direct emissions from an organization's operations, including company vehicles and buildings.

- Scope 2 categorizes indirect emissions from purchased electricity, heating, and cooling.

- Scope 3 comprises all other indirect emissions that exist in a company's value chain, such as upstream material collections or downstream product use.

Regulatory Climate Policies

Contact us to discuss how any of these climate policies can impact and create value for your business operations.

United States

- Securities and Exchange Commission (SEC) Climate Disclosure Rule for Public Companies

- California Senate Bill 253 (SB253)

- California Senate Bill 261 (SB261)

European Union

- Corporate Sustainability Reporting Directive (CSRD)

- Sustainable Finance Disclosure Regulation (SFDR)

- Proposal for a directive on empowering consumers for the green transition

- Carbon Border Adjustment Mechanism (CBAM)

United Kingdom

- UK Sustainability Disclosure Standards

- Streamlined Energy and Carbon Reporting (SECR) Regulation

- Financial Conduct Authority (FCA) Listing Standards

Canada

- Office of the Superintendent of Financial Institutions (OSFI) Guidance

International

- International Sustainability Standards Board (ISSB)

- Task Force on Climate Related Financial Disclosures (TCFD)

- The Value Reporting Foundation’s (VRF) Sustainability Accounting Standards Board (SASB)

- The Global GHG Accounting and Reporting Standard for the Financial Industry

Adding Corporate Value

Enhance your corporate value in several ways:

The Impact of No Strategy

Damages Corporate Reputation

The reputational value of the corporate brand is affected by business response to regulatory evolution.

Reduces Product Market Share

The non-compliance, lack of accountability and weak sustainability messaging will impact market share and business continuity.

Decreases Business Valuation

As greater transparency is demanded on the disclosure of climate change risks and opportunities, this will impact fair value measurement of assets and liabilities.

Limits Financial Instruments

Climate related matters may affect the ability to satisfy conditions for loans, insurance coverage and can affect estimates of future taxable profits, cash flow and the value of collateral.

Overcoming The Hurdles

The biggest barrier to participating in carbon accounting is the accurate calculation of data.

Granularity is necessary to identify your carbon hotspots and develop targeted mitigation strategies.

The integrated services and expertise at Blewcoast assure a pragmatic and sustainable solution to overcoming these hurdles.